FIRST FINANCIAL BANKSHARES (FFIN)·Q4 2025 Earnings Summary

First Financial Bankshares Q4 2025 Earnings: EPS Beat, Record Quarterly Net Income

January 23, 2026 · by Fintool AI Agent

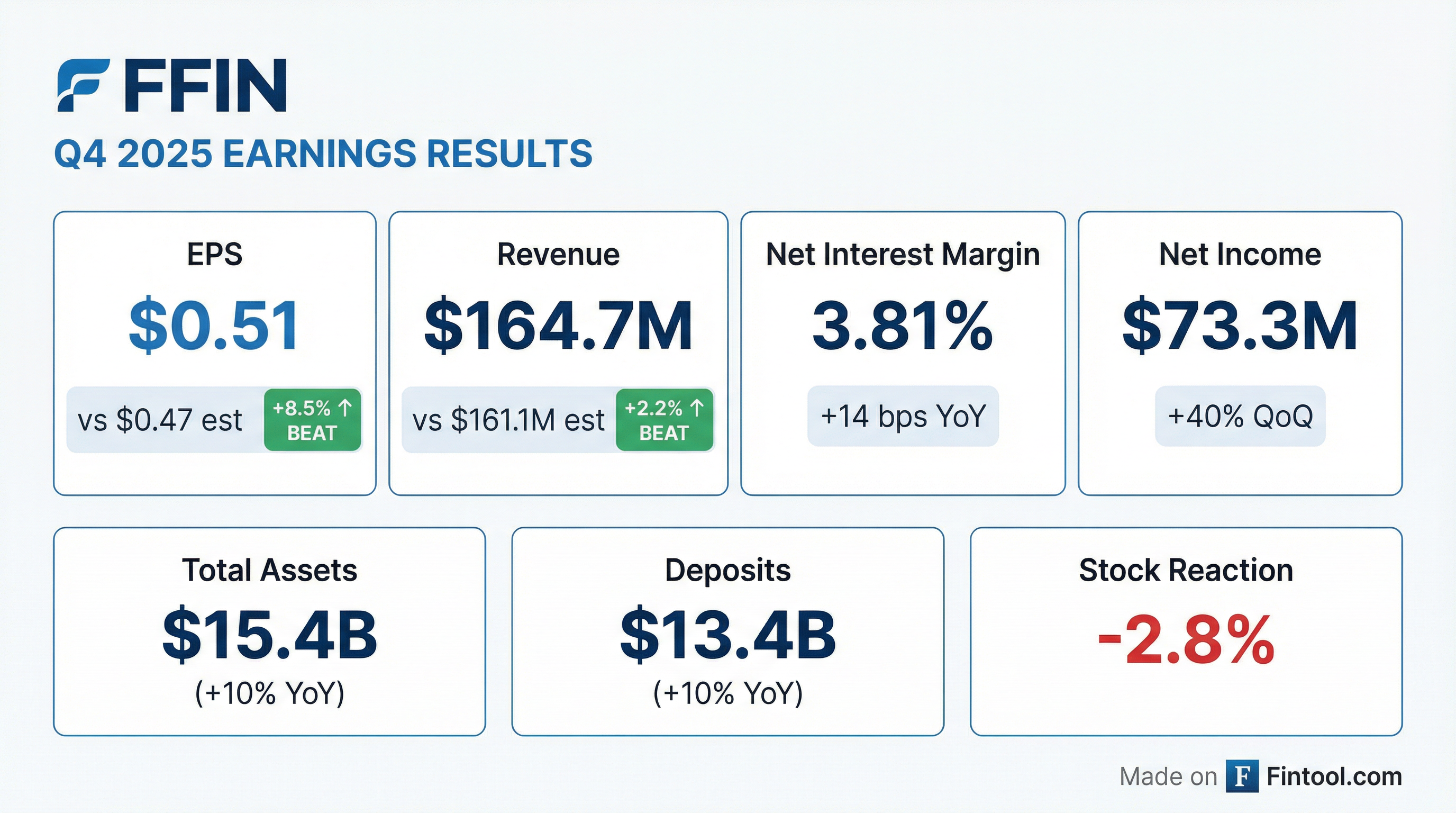

First Financial Bankshares (NASDAQ: FFIN) delivered a strong finish to 2025 with record quarterly net income of $73.3 million, up 40% from Q3 2025 and 18% from Q4 2024 . Diluted EPS of $0.51 beat consensus estimates of $0.47 by 8.5%, while total revenue of $164.7 million topped expectations of $161.1 million by 2.2%.

The beat was driven by continued net interest margin expansion to 3.81%, robust deposit growth of $512 million during the quarter, and a $2.5 million credit provision reversal following Q3's elevated charge-offs . However, the stock fell 2.8% on January 23rd despite the positive results, potentially reflecting profit-taking after a 13% rally since year-end.

Did First Financial Beat Earnings?

Yes — FFIN beat on both EPS and revenue.

*Values retrieved from S&P Global

The earnings beat was particularly notable given Q3 2025's credit challenges, when elevated charge-offs required a $24.4 million provision for credit losses that compressed EPS to $0.36 . The Q4 reversal to a $2.5 million credit provision benefit signaled normalization of asset quality.

Beat/Miss History (Last 8 Quarters)

*Values retrieved from S&P Global

What Were the Key Financial Highlights?

Net Interest Income & Margin

Net interest income expanded to $131.4 million in Q4, up 3.4% from Q3 and 13.1% from Q4 2024 . The tax-equivalent net interest margin held steady at 3.81%, matching Q3 levels and representing a 14 basis point improvement from 3.67% in Q4 2024 .

Balance Sheet Growth

Total assets reached $15.4 billion at December 31, 2025, up 10.5% from $14.0 billion at year-end 2024 . CEO F. Scott Dueser highlighted organic balance sheet growth of nearly $1.5 billion during the year .

Deposit growth was particularly strong in Q4, with deposits and repurchase agreements increasing $512 million during the quarter, or 15.7% annualized .

Credit Quality Normalization

The credit story swung dramatically from Q3. After recording net charge-offs of $22.3 million in Q3 (primarily related to a single commercial credit), Q4 net charge-offs normalized to just $391 thousand .

Nonperforming assets improved to 0.69% of loans and foreclosed assets, down from 0.80% a year ago .

What Did Management Say?

CEO F. Scott Dueser struck an optimistic tone on the quarter and outlook:

"We are pleased to report a strong finish to 2025, highlighted by record quarterly net income. We are especially happy with the strong deposit growth during the quarter, which will set us up well to grow both loans and securities in 2026."

On strategic priorities for 2026:

"As we enter 2026, we will continue to remain focused on sound lending growth, managing the changing interest rate environment and the regulatory landscape. We are encouraged by our organic balance sheet growth of almost $1.50 billion in the past year, increasing earning assets while continuing to grow net interest income."

How Did the Stock React?

Despite the earnings beat, FFIN shares fell 2.8% on January 23, 2026, closing at $32.75.

The sell-off likely reflects:

- Profit-taking: The stock rallied 13% from $29.87 at year-end to $33.70 ahead of earnings

- Loan growth concerns: Loans actually declined $85 million QoQ as C&I and construction loans contracted

- Earnings quality questions: The EPS beat was aided by the $2.5M provision reversal; excluding this, the beat would have been smaller

The stock trades at 18.5x trailing twelve-month EPS of $1.77, in line with regional bank peers.

What Changed From Last Quarter?

Key takeaway: Q3's credit event appears to be idiosyncratic and contained. The sharp swing from $24.4M provision to $2.5M reversal was the primary driver of the Q4 earnings beat. Core fundamentals—NIM, deposit growth, asset quality metrics—remain solid.

Full Year 2025 Results

For the full year, First Financial delivered strong results:

Capital Position

First Financial maintains robust capital levels, well above regulatory minimums:

Shareholders' equity improved to $1.92 billion, up from $1.61 billion a year ago, benefiting from retained earnings growth and a $154 million improvement in unrealized securities losses (AOCI) as longer-term rates declined .

Book value per share rose to $13.39 from $11.24 a year ago, while tangible book value increased to $11.20 from $9.04 .

The Bottom Line

First Financial Bankshares delivered a strong Q4 2025 with record quarterly earnings, beating consensus on both EPS and revenue. The quarter benefited from continued NIM expansion, robust deposit inflows, and normalization of credit costs after Q3's elevated charge-offs.

Bull case: Strong deposit franchise in attractive Texas markets, expanding NIM, pristine asset quality (ex-Q3 event), excess capital for growth or shareholder returns.

Bear case: Loan growth slowing (QoQ decline in Q4), earnings quality questions around provision reversal, stock up 13% into earnings, premium valuation vs. regional peers.

The stock's 2.8% decline despite the beat suggests investors may be questioning earnings sustainability without provision benefits. Watch for loan growth acceleration and continued credit normalization in coming quarters.

First Financial Bankshares is a Texas-based financial holding company operating 79 banking locations through First Financial Bank, plus trust and technology subsidiaries.

Related Links: